Why PayHalal?

PayHalal and Digital Islamic Economy bridging Muslims all over the World

The rise of the Islamic economy is a force to be reckoned with. Not only is it transforming the global digital Islamic economic landscape in the 4th industrial revolution. Islam is so much more than a set of shariah laws set to protect Muslims against secular prohibition this includes money matters and the concept of Digital Islamic economy .

Sirot al Mustaqim is at the centre of everything a Muslim does, a narrow right bridge which is fundamental to Islamic belief system which simplifies and rationalises everything including trade and finance.

Islamic digital economy transformation is rapidly growing , dispelling ambiguity and uncertainty and riba .

Digitalisation of the Islamic Economy is expanding the growth of the Halal eCommerce as the Muslim consumer demand for goods and services to meet Halalan Toyiban Standards. It is not too surprising, since Islam is the fastest growing religion in the world.

In the world of Islamic finance, Malaysia is contributing to expansion of the digital Islamic economy ecosystem.

On strategy is to educate engage and empower Muslim consumers about Islamic digital Economy and PayHalal will be bridging the gap in the Halal market place by increasing understanding of how halal e-commerce and Islamic payment gateways and instruments can Intergrated to meet global Halal standards.

The fundamental of Islamic finance is about profit and loss-sharing without riba. With the digital wave taking over of Islamic finance, consumers are moving away from the conventional Islamic banking model — which many would argue is interest bearing speculative according to Western models — and turning to a syariah-compliant model.”

Ethical business practices with profit and loss-sharing concept is very much at the heart of Islam a principle of doing business from the days Prophet Muhammad. PayHalal strives to make sure that everything is based on Sirot al Mustaqim which demonstrates Islamic ethics and integrity, which is what Islam is all about.

Fardu Kifaya compels us at PayHalal to make available a payment gateway for Muslims so that spirituality and finance can go hand in hand, and especially when it comes to Muslim personal obligations.

"And whatever you give for interest to increase within the wealth of people will not increase with Allah . But what you give in zakah, desiring the countenance of Allah - those are the multipliers." - Surah Ar-Rum [30:39]

The conventional methodology of digital payments lack a clear end to end syariah and halal process, especially when considering processing, clearance and settlement as well as mixed float accounts.

PayHalal’s role extends merely beyond facilitating payments e commerce companies like alibaba, ebay etc .The most important role PayHalal plays is to protect Muslims online by ensuring the following- PayHalal guarantees that the money that goes through PayHalal payment gateway is not tainted. These guarantee is possible because our payment process is untainted with riba-element eg we use Islamic trust/deposit account while the secular Payment gateways use conventional Financial instruments, the hibah we give merchant is based on returns derived from islamic investments, etc.

For Muslim owned and Muslim led Merchants, PayHalal helps them keep their income untainted, thus give them peace of mind in their business dealings.

Rasulullah (S.A.W) once remarked, “If a person buys a cloth for ten Dirhams,

and out of them one is tainted (i.e. it has been acquired by unfair means), none of his Salaah will be acceptable to Allah as long as he wears the cloth.” (Musnad Ahmad).

PayHalal makes it our business to ensure a wholesome halal ecosystem for our merchants and their consumers.

Awareness of PayHalal as a robust, feature-rich Islamic payment service is surprisingly high.

The PayHalal Advantage

For the thousands of businesses opening an online storefront targeting Muslim Consumers , PayHalal is becoming less of a nice-to-have payment option and more of a must-have. The reasons described in the sections that follow are a few examples of why PayHalal ’s value proposition to merchants is so compelling, and why both small and large businesses are turning to PayHalal not only as a payment option, but also as a stand-alone payment solution.

Increased Sales from the Halal Market

PayHalal research shows that the more payment options you provide to customers, the more sales you will make. In fact, online merchants that add PayHalal as a payment option to sell to Muslims see an average sales increase of 14%. The reason is simple: Muslim buyers love to use PayHalal simply because the brand resonates with their believe system . With over 1.6 billion Muslims worldwide , there is a massive core group of loyal Muslims consumers to be acquired online via PayHalal.

Assuarance for Muslims

PayHalal lends credibility to non Muslims business owners operating in the Halal market space. By offering a Islamic payment service they’ll build trust,confidence and respect from their Muslim customers and the beauty of it all is that the customers don’t have to submit their credit card number or any banking instrument information over the Internet, merchants can instill confidence in their Muslim users who are hesitant to buy from a site that they may have never visited or even heard of before by just having PayHalal there. The strength of the PayHalal brand will make a difference in helping many new businesses get off the ground and establish themselves in a massive global online Halal marketplace.

PayHalal Explained

PayHalal’s role in the Islamic Finance world

What are the fundamental principles that shape the digital Islamic Payment gateway ? How are Payment and e commerce entrepreneurship work in the Muslim world? We examine the Islamic model of Payment gateway and its products, how they are used to help eliminate was-was.

The foundation of PayHalal is based on the pillars of Islam:

The impact the divine law has on the practice of finance is evident. Shari’a has guidelines on the types of activities that are permitted within a payment gateway like PayHalal if it is to be considered ‘Shari’a compliant.’ Shari’a prohibits PayHalal from investing in or supporting businesses that deal in the sale or production of pork or alcohol; nor can the institution be involved with businesses that profit from gambling operations and Riba. In addition, there are several key aspects of Islamic financial institutions, which set them apart from their western counterparts.

Distinctive Features of PayHalal

The first and most distinctive feature of Islamic finance is there is no concept of the time value of money. A dollar is worth the same today as it is to someone three months from now. This is in stark contrast to the western view of money – a Ringgit is worth more to me now than it is three months from now. According to modern (western) finance theory, for those three months, I could have that dollar sit in a bank account and earn interest for three months so that once three months have passed, I will have more than a Ringgit . Therefore, when I am lending money to someone and not getting it back for a period a time, I am to be compensated by the borrower for the opportunity cost of not receiving interest from that money.

Second, and closely linked to not having a time value of money is the Qur’an’s strict prohibition against the collection of interest or riba, which is sometimes translated also as usury or exploitation. The prohibition stems from the belief that money and profits are earned. The charging of interest is considered unlawful gain, as the financial institution is not really providing any service to the borrower, but is profiting from merely existing and being able to lend money. Some adherents to this belief view people that store their money in banks as hoarders, believing that money is not be socked away in banks earning interest, but should be used to support entrepreneurs and the development of Islamic enterprise.

Third, risk taking or gharar is to be avoided as much as possible. In an Islamic contract the price, quantity, and time of payment must be known prior to entering into the contract with the other party. This practice ties in to some of the other characteristics of Islamic finance, but may have something to do with the culture and customs of the people that settled the area. The Middle East is home to people whose ancestors were nomadic, tribal people, who lived off of the land and never took more risk than was necessary. This history of risk avoidance seems to continue to play out in the region’s financial sector. However, it is this aspect of Islamic business that we again see the impact that the teachings of Allah. Life insurance, a familiar financial instrument for most in the West, is shunned by Muslims because Allah knows the time and place of each person’s passing, their time on this earth being predetermined. Mechanisms have been developed to help ameliorate the consequences of the risk of death from everyday life, with the focus on zakat, social security, and laws of inheritance that allow people to take care of their family members after they pass (Malkawi).

WHAT IS PAYHALAL PAYMENT GATEWAY AND WHAT IS ITS ROLE IN ISLAMIC HALAL E COMMERCE?

If you run a Halal or Islamic ecommerce site, then you’re going to need a Islamic payment gateway that’s shariah Compliant , there’s no way around it. If you’re a newbie to the world of payments, this may seem extremely complicated and out of you league.

The truth is, payment gateways aren’t as nearly complex as you may have initially believed.

WHAT IS PAYHALAL?

PayHalal is the world’s first Shariah-compliant (Islamic) payment gateway. By Shariah-compliant we mean that:

- Products and services that you are purchasing as a consumer through merchants that use the PayHalal payment gateway to sell to you and/or to accept your payment are halal (lawful for consumption/use by Muslims) according to Islamic law (Shariah).

- Payments that you are accepting as a merchant or as a biller via the PayHalal payment gateway for purchases made by your customers are free from riba (interest), maysir (gambling), and gharar (uncertainty).

- Payments that you make to a biller or funds that you transfer to your children using the PayHalal payment gateway are free from riba (interest), maysir (gambling), and gharar (uncertainty).

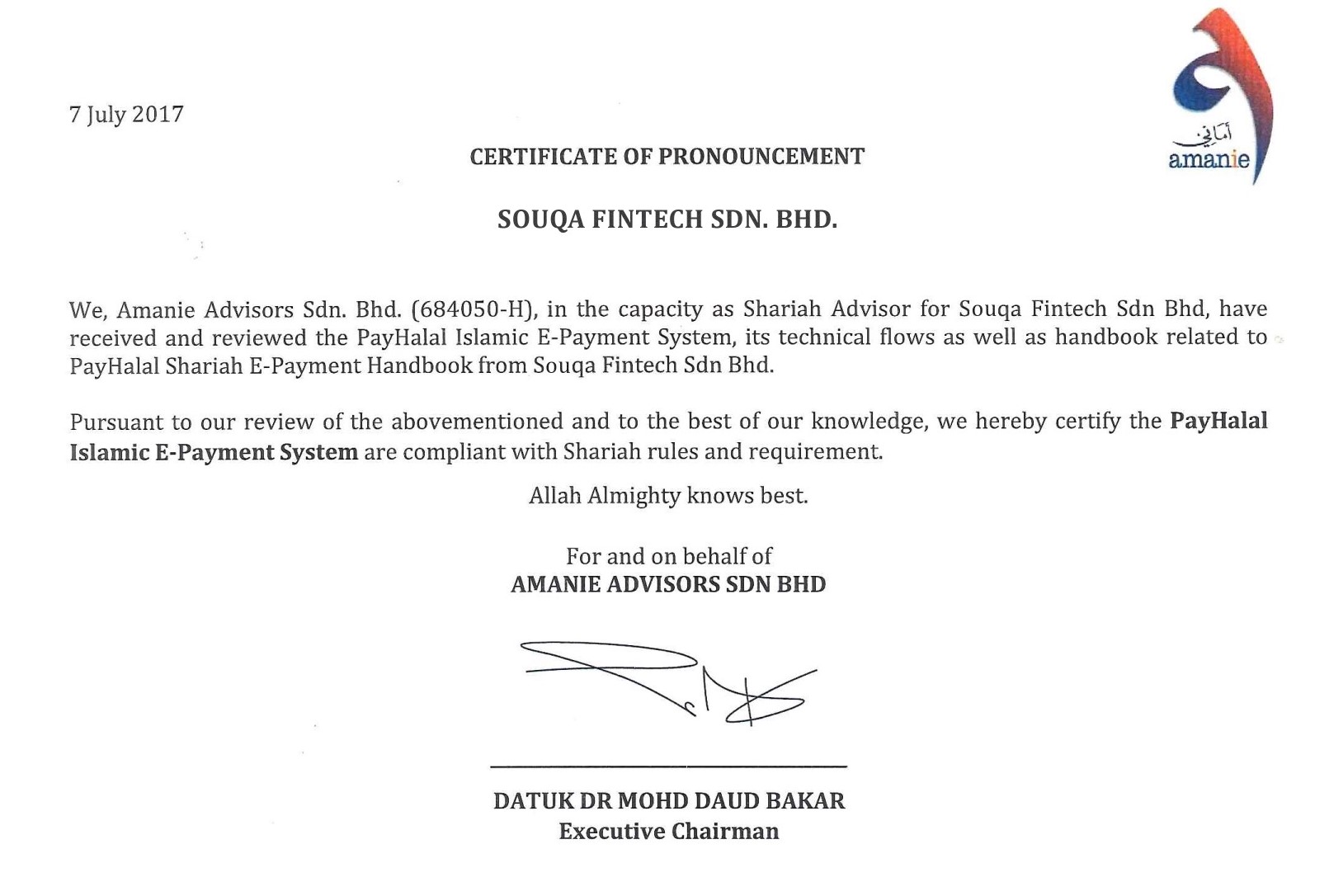

PayHalal has been certified as being Shariah-compliant by

Amanie Advisors Sdn. Bhd. For more information on

Amanie Advisors Sdn. Bhd and their certification of PayHalal, please visit their website at:

https://amanieadvisors.com/

WHAT WE OFFER

To Merchants

- A Shariah-compliant payment gateway to accept payments that are free of riba (interest), maysir (gambling), and gharar (uncertainty) from customers.

- Hosting of your online store on our e-commerce gateway to showcase and sell your halal products and services to customers worldwide.

- Vetting of your products and services by PayHalal to provide Muslim consumers with peace of mind that they are halal and may be purchased and consumed without doubt as to their status.

To Billers

- A Shariah-compliant payment gateway to accept payments that are free of riba (interest), maysir (gambling), and gharar (uncertainty) from customers.

To Charities

- A Shariah-compliant payment gateway to accept donations that are free of riba (interest), maysir (gambling), and gharar (uncertainty).

To Muslims

- A Shariah-compliant payment gateway to make payments that are free of riba (interest), maysir (gambling), and gharar (uncertainty) to merchants and billers.

- A Shariah-compliant payment gateway that ensures that your payment of zakat, donations to other charities, and funds transfers to your children studying at university are free of riba (interest), maysir (gambling), and gharar (uncertainty).

- Assurance that all merchants registered with PayHalal are legitimate, functioning businesses, eliminating your risk of loss in dealing with online scammers

- Assurance that products or services that you purchase from merchants using PayHalal’s services are halal for consumption or use by Muslims.

To Non-Muslims

- The availability of a payment gateway, e-commerce platform, and products and services that are aligned with your own values and concerns about responsible finance, social justice, and a healthy lifestyle.

HOW DO WE ENSURE THE SHARIAH COMPLIANCE OF THE SERVICES THAT WE PROVIDE?

First, PayHalal does not invest in or support businesses involved in:

- the production or sale of pork, alcohol and alcohol-related activities, non-halal food and beverages, tobacco products (including e-cigarettes), drug paraphernalia, pornography, guns, and other arms

- gaming and betting

- Shariah non-compliant entertainment

- conventional insurance

- jihadist or terrorist activities

We perform halal and Shariah audits of merchants wishing to use PayHalal’s payment gateway or set up an online store on our platform. Only those that pass the audits are allowed to use our services.

Second, conventional digital payment gateways lack a clear end-to-end halal and Shariah process, especially when the processing, clearing, and settlement of payment transactions with merchants and individuals uses funds from both halal and non-halal sources and bank accounts. PayHalal guarantees that the money that passes through its payment gateway is not tainted. This guarantee is possible because PayHalal’s payment process only uses funds from riba-free Islamic trust or deposit accounts rather than conventional interest-bearing accounts. In addition, any gifts (hibah) that we provide to merchants are based on returns derived from Shariah-compliant Islamic investments rather than from interest.

Third, PayHalal uses the Islamic contract of Wakalah Bai Al-Ujrah (agent with compensation) in its relationship with merchants. This contract appoints PayHalal as an agent to act on behalf of a merchant to collect and process customer payment information and settle payments with financial institutions for goods or services provided by the merchant. In exchange for acting as the merchant’s agent, PayHalal is entitled to receive a payment from the merchant for services performed on its behalf.

Fourth, PayHalal checks the halal status of the merchant’s products and services against those in PayHalal’s HalalCart database. Transactions involving the purchase of products or services classified as haram will be rejected outright. Customers wishing to buy products or services classified as “doubtful” (i.e., it is unclear whether they are halal or haram) will only be allowed to purchase them after agreeing during the purchase process to assume responsibility for the risk associated with their use or consumption.

Finally, PayHalal uses a form of artificial intelligence (AI) known as “robo advisory” to determine if any activity on the PayHalal payment gateway has involved the use of Shariah non-compliant funds. For example, some customers may have paid for purchases using a non-Islamic credit or debit card, tainting the funds collected by PayHalal. The robo advisory analyzes transaction data and produces a report for PayHalal indicating all instances of Shariah non-compliance. The report includes the robo advisory’s recommendations regarding how such instances should be treated. In some cases, the recommendation may involve “cleaning” the funds by donating them to charities or to the poor. PayHalal’s Shariah Advisory Committee would review the robo advisory report and make a decision regarding the disposition of the funds.

PayHalal Payment Gateway Features

In addition to accepting online payments, payment gateways are also capable of helping you with the following:

* Halal Market Assurance With PayHalalPayHalal provides payment processing services for Halal & Islamic merchants only so that the Muslim Consumer doesn’t have to worry about breaking Islamic Laws.

* Payment Information StorageStoring payment information so that the customer doesn’t have to constantly re-renter their information. This information is encrypted so it ensure’s that the information is securely stored.

* EncryptionAll payment gateways encrypt sensitive payment information prior to them transmitting it to the processing bank.

* Recurring BillingSubscription-based pricing is becoming increasingly popular payment gateway. The subscription offers a recurring billing feature so that you can automate this process.

* PCI CompliancePayHalal Payment gateways is PCI compliant so that you can accept payments securely, while avoiding costly fines.

* API Tools and Developer InformationOn the technical-side, most payment gateways give you the ability to customize it to fit your specific needs.

* IntegrationPayHalalPayment gateways generally integrate with other tools, such as your accounting softwares and logistics .

How To Pick The Right Payment Gateway For Your Ecommerce Website

When selecting payment gateways there are two options; hosted and integrated.

Hosted payments gateways, such as PayHalal, redirect your customers to the payment platform’s processor to complete the transaction. The benefit of this gateway is that it’s responsible for all PCI compliance and data security.

Integrated gateways allow you to connect your eCommerce website through PayHalal gateway’s provided API. This means your customers aren’t redirected to another site so you aren’t harming your conversions.

However, Merchants are responsible for the security of your customer’s data.

PayHalal integrated gateway allow merchants to customize it’s features so you need to be familiar with some basic programming. You may even wish to hire a programmer or contact PayHalal support team for assistance (Costs apply)

Fees include MDR% for Merchants and Ujarah Transaction Fees . Out Of Scope transactions there will be additional cost imposed for batch processing fee, fund transfer fee, and termination fees.

What currencies does the gateway support?

PayHalal currently accepts MYR.

PayHalal will be handling 5 major currencies by 2020.

What fraud prevention tools does the gateway offer?

Preventing fraud is a full time job. It provides Card Verification Value (CVV) and Address Verification System (AVS).

Prohibited Categories

The following are considered higher risk businesses:Non Halal categories, gaming,terrorism crowdfunding,gambling,betting,e-cigarettes, drug paraphernalia, pornography, alcohol and gun, Jihadist activities, travel to Israel, debt collection, and diet program, are classified as high risk products. This means that PayHalal gateway will not support processing transactions related to these products.

Will PayHalal payment gateway grow with your business?

PayHalal will definitely grow your business especially if your target consumers are muslims.Islam is the world’s fastest growing religion therefore the Muslim population is steadily growing it is estimated the total population will rise by 30% by 2050.

The global halal market size was hit USD 5.73 trillion in 2016.So if you want to effectively reach deep into the pockets of your Muslim shoppers sign up PayHalal as your Payment Gateway. when it comes Food and Money halal will be the most important thing to Muslims.